General Investing

Don’t do what I did - executing on a plan and starting early can make life so much better

How many of us learned about investing and budgets in school?

Yeah, I certainly didn’t. Well, but I’m an engineer, so it should all be easy, right?

Not so much. While I did work my way through university while running a business and holding 2 other jobs in parallel and have certainly had some ups and downs, I can say I’ve been relatively blessed in my career trajectory outside of one of the bigger recessions.

I have had a couple of looking for work periods much longer than I'd expected, but overall, even when some surprises have come along the way, one door closes and (eventually perhaps) another door opens.

I got the simplified view of ‘don't leave that free money on the table,’ meaning that if you have an employer matching contributions to a retirement/401K account - absolutely you should be ensuring you at the least max that out. Not gonna lie - there were a few periods of time across the years I probably didn’t follow that one. The whole job market at one point was pretty rough for a while, to the point I almost had to rebuild my career for a bit so didn’t save as much as I should have into retirement/401ks, while the whole concept of a ‘budget’ kind of ‘visited’ in and out of my life. Of course, during some harder times, I’d be paying attention to every dollar spent, and I’d always keep awareness of if month-to-month I was growing my bank account balances or seeing them shrink, but there was a pretty good amount I could have/should have done differently.

It’s never too late to start, but starting early sure can help!

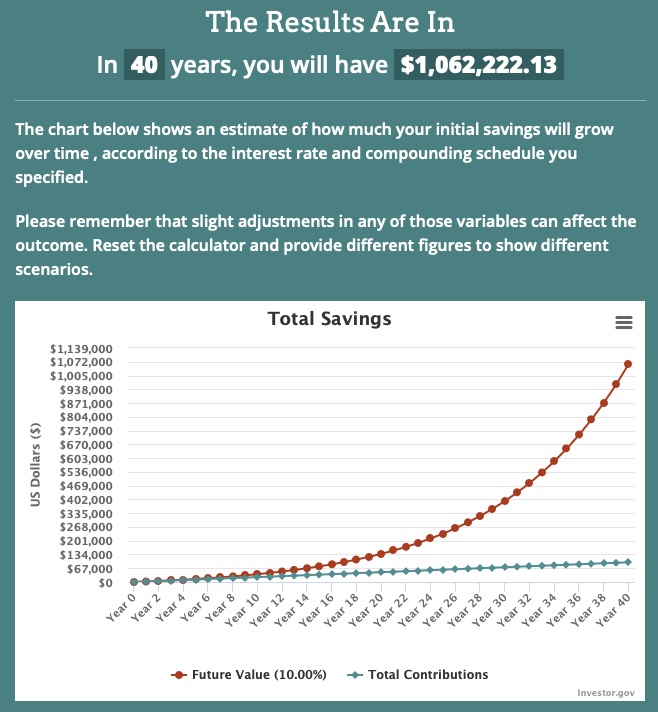

If someone were to start investing $200/month at 21, and continued through 35 and then just stopped but left the investment alone, assuming an average rate of return of 10% annually - they would have over $1.25 Million by retirement age.

If someone instead started contributing at age 30, they would have $600-700K at retirement.

If they started at for with the same contribution level, they would only have ~$230,000.

Time and compounding gains over time can make a huge difference. While it’s possible for someone starting at 40 to catch up compared to those who started investing (including in 401k/401b/IRAs), they would need to save significantly more each month compared to the others. There is a quick calculation, the Rule of 72 - divide 72 by the interest or growth/appreciate rate to get the amount of time to double your money. For example, if you expect to see roughly 10% annual returns, 72 / 10 = 7.2 years to double your investment. Note this is without adding additional investment but it’s a good ballpark formula to keep in your head.

I can certainly say that I didn’t start at 21, although I wish I did, as it would probably have tripled my existing holdings. Regardless of wherever you are, it’s worth starting, or perhaps fine-tuning, as soon as you can.

Invested money at ~7% can double in 10 years but 10x in 20 years.

Where should I start?

We’ve all got our own unique specific circumstances and ‘where we are right now’, which need to be taken into account. However, there are a few common desired starting points to consider, even if not possible to immediately attain.

-

The 75 / 15 / 10 rule is a budget framework which recommends allocations as follows

-

10% to savings which includes things like an upcoming car purchase or other significant expense, building out an emergency savings (initially target 3 months covering expenses, then 6 or 12), or a combination thereof.

-

15% to investments which could include a 401K or IRA retirement plan, an investment account (make sure you are maximizing any employee matching funds into a 401K or IRA first though!), or a combination of both.

-

75% to mandatory expenses like rent or mortgage, groceries, utilities, insurance, etc.

-

I intentionally put them in this order, as following this in order could help to determine if you are living beyond your means. Luxuries like eating out or regular food delivery would fall into the 75% bucket once your recurring ‘always’ expenses are met, but only after you put 10% into savings and 15% into investments. It might show that you need to cut back on Doordash or consider how much your rent or mortgage is if you’re initially unable to get to the 10/1575 allocation and give you a starting point to work on.

Note that you can always adjust either of the savings or investment percentages to be higher, but you really need to keep them as a minimum. Some people use the phrase as ‘pay yourself first’ by following those two percentages (or higher), before jumping into the 75% category, which really means to put the first 25% prioritized over your desire for a nicer house/apartment/car if it means exceeding the 75% and to not sacrifice the saving and investing for your future.

I’ve always been consciously aware of my monthly expenditures and their impact on my bank accounts, so in a way I’ve followed this, meaning I’d dig in if my account balances weren’t rising month to month, but I wasn’t nearly as disciplined as I could have been back then, and it probably cost me thousands in lost gains. But there is some good news - we can make this easy and automated.

But first, we need to do some housekeeping

This one isn’t the most fun. If you already pay everything via bank account and a single credit card, it’s a lot easier, but regardless, we need to take a look at collective outgoing expenditures, ideally over a minimum of the last 3 (full) months. Going to 6 or 12 would be even better if possible. This means ALL expenses, as in even if you have some money sitting in PayPal you’ve been slowly using for DoorDash or whatever, you need to include them.

Break things down into the major categories from the 10/15/75 (usually referred to as the 75/15/10 rule, but for our purposes..) - savings, investments (including IRA or 401k contributions made by you - don’t include any employer matching funds if you have those), followed by the 75%. For the 75% I’d break it down further into necessities and luxuries, as in you must pay for rent/mortgage, utilities, internet, mobile phone, groceries, gas or bus/train expense to/from work, and include car payment, eating out or food delivery, clothes, movies, streaming services, and others as ‘luxuries.’ This isn’t to say you don’t need a car, but for example, to help call out if your payment is within your means to get your overall budget, savings and investment on track, or if it may be too high. I would initially also include eating out at work lunches as a luxury for now. If you’re like me and my family, well - be prepared to be shocked at what a single Doordash dinner and 1-2x dinners out will likely be adding up to. :(.

Don’t micro-analyze the 75% yet, just get the numbers and category/sub-category done first, then let’s move on to the investments which should be easy - if you’re contributing to an employer-sponsored 401K, 403b, or IRA, or a personal IRA, those numbers are easy enough to get.

For savings, regardless of whether or not they’re going into a checking, savings, or other account, this is really the net of what’s left. Take the average of your 75% group(both necessities and luxuries, the actual total divided by the time period) and subtract it from your net (post-taxes) pay (also averaged if changes over time), then subtract your investment contributions. What’s left is effectively your average ‘savings’ regardless of where that $ is winding up currently.

Write down (paper, OneNote, Wordpad, Excel, whatever works for you) your numbers for each of the 3 - savings, investment, and your 75% group. As a quick sanity check, total the 3 numbers up and compare it to your paychecks - they should match or be very close, unless you’ve been drawing down from savings month to month/week to week, or had some extra money come in during the period.

We’re looking for the real, repeating month to month numbers versus your normal recurring income

Next to the 75% group #, split it out further into necessities and luxury totals.

Now, look at it, honestly - are you at or above 10% savings, 15% investment, or at the least at 25% or higher outside of your ’75% group’? If so, great! We can fine-tune things from there...

If not, it’s time to start looking at your ‘luxury’ expenses

Our new goal is to see what it would take to get your #s outside the 75% group to be 25% or more. You can take the list of luxury items one at a time, with their name/what they are and cost on them and try ranking them. I intentionally say rank them because that means each item has a specific location and position top to bottom. Figure out how much you need to get out of the 75% group to make sure you’re at 75% or less, then starting at your bottom/lowest ranked luxury item, go upwards, subtracting the amount of each in turn until you’re at 75% or less.

This may need some soul-searching and brutal honesty

If you need to ‘trim the 75%’, no one really enjoys this. However, it’s also possible you simple never added some of these things up so perhaps the choice is easier, at least on some of them. It’s ok if you feel you would rank ‘eating out with the team at lunch’ high, but perhaps you can cut down on streaming services, or don’t have dinner delivered as much? Maybe it’s setting a limit to monthly clothes purchases, or tools, or something else. Hopefully it’s reasonably easily achieved, but sometimes, for some people and their situations, it may not be.

If so, well - it’s really not just you, but you can get there. A former manager of mine, who was a pretty well-paid VP, had a habit over time of buying a new car, usually a Mercedes or BMW, but then would wind up trading it in every 2-3 years. She was visibly upset once day so I asked what’s wrong - well, it turns out on most of her trade-ins, she was getting further and further ‘upside down,’ meaning she owed more on the loan that the past several vehicles were actually worth, so she got quite a shock this round when they showed the numbers - as she made very good money, they would still do the financing, but effectively paying $70K for a $50K vehicle right out of the gate - wasn’t exactly a ‘good deal.,’ and that’s before adding in interest! Cars are among the worst assets with respect to depreciation - typically cars lose 20% of their value in the first year, regardless of condition or mileage, then 15% a year for the next 4, so a $50,000 new vehicle may be worth only $16,000 after 5 years. Of course, there are nuances and variability in that, but cars depreciate very quickly, especially in the first 3 years. In hindsight, this is at least one thing I’ve generally done right - I’ve owned dozens of cars, but all but once have bought used.

We had a bit of a discussion, and I eventually convinced her to go for a 3 year-old mid-market SUV. She saved a ton and wound up loving the vehicle. She still overpaid, but it changed the pattern of thinking on new vehicles and ultimately freed up a lot more cash for things she’d appreciate more.

So, you’re going to have to consider what really can work for you. Maybe it’s dropping 6 streaming services down to 1 or 2 and rotating them after watching what you wanted to, buying a 3-4 year old low mileage car instead of new. The goal isn’t to make you miserable, but to make sure the ‘future you’ is taken care of. Many of us have ‘luxury’ items covered in the 75% that once we start to look at the actual numbers, we almost feel guilty for spending that much on <whatever it is>, or realize that just cutting down spending in 1 or 2 areas may open up a bunch more possibilities whether it’s saving for a vacation, for emergency funds, freeing up cash for regular investment, whatever.

If your situation is such that there simply is no way to carve out 25% monthly, then at least make changes and a plan to get there… and save and invest what you can.

It’s worth considering, especially if you can’t (yet!) reach the 25% or more goal to carve out for savings and investment, consider the following order to allocate what you’re able to, while working on a way to reach the goal in the future.

-

Employer matched funds - if your employer matches some level of contribution, it’s usually up to some maximum amount, and this is both effectively ‘free money’ but also a larger base to see compounding gains over time. Make sure to at least contribute enough to get the full employer match. Even if you need to do less or it takes some time to meet the other goals (15% investments, 10% savings), make sure you at least do this one out of the gate/from the start.

-

Higher interest debt - the general rule is if it’s over 6-7%, you should try to get this paid off. This does not include a mortgage if you have one, but nearly all credit cards (if not all) today, personal loans and the like are almost all guaranteed to be at or higher than this rate.

-

Get at least $1000 saved in savings as the start of your emergency fund.

-

Get 15% going to investments. Don’t worry if this isn’t immediately hitting 15% of gross pay. You can also split it 50/50 initially with savings, but even getting started with smaller amounts, especially if you’re still in your 20s or 30s, can have a positive snowball effect over time. I’ll also cover HOW to do this in a separate article.

-

Get 3 months of emergency savings - this is 3x your necessities amount, to make sure you have some cushion in the event of job or life changes,

-

Get to the full 10 / 15 / 75 allocation and then congratulate yourself!! And then evaluate. You may find you have excess savings once you hit this milestone, and can consider additional investments, Certificates of Deposit(CDs), a separate High Yield Savings Account(HYSA), starting a 529 College Savings Account if you have kids, or looking into an HSA (Healthcare Savings Account). We’ll cover most of these in a separate article, but at least for now - congratulate yourself and let’s look at how we can ‘make it easy’ and automate it in the next article.

One last thing

Everyone’s situation is a bit different, and many of us are at different life stages. In my 20s, I managed to save up ten thousand dollars or so at one point, but really didn’t know ‘where to put it to most use’ so it sat in my checking account, and was eventually…spent. We’ll sort how to not wind up doing the same.

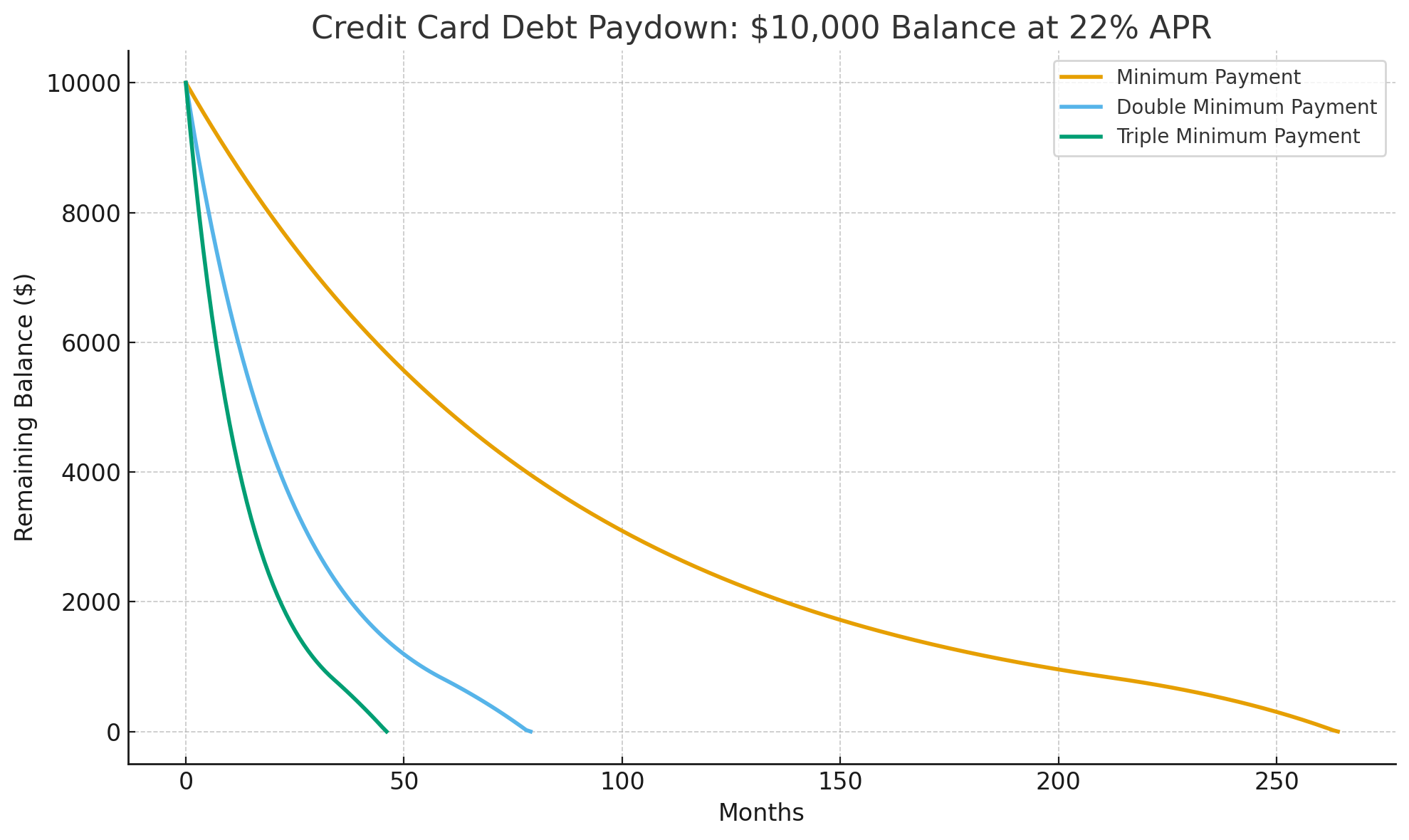

You may want to target specific bills or credits cards first. Take a look to the right -unfortunately paying minimum payments on credit cards can take a looong time to get them down, but if you can perhaps double or triple the payments on at least one card - you can get them zeroed out a lot quicker. Personally, I went from having a dozen different cards, with several of them carrying balances, to 3 cards, effectively a primary and secondary (not to use the full credit, but not everywhere takes the first card), and a third card from my bank which is rarely used - and pay all in full each month. This took a bit to get to, but it’s worth getting there!

Don’t worry if you can’t hit all the percentages from the start, and it’s ok if you need to juggle goals for a bit. Do what you can. If you have multiple credit cards, and a few have low balances, maybe beat those up with larger payments to get them to zero - and then put them in a drawer and stop using them for a while… then go on to the next. You may decide that some bills are going to be a big lift or long time to get down, but decide to still start saving and investing, perhaps 5% each. That’s ok too, but don’t ignore getting those high interest cards paid down, make sure you get the ‘free money’ from your employer via 401k/retirement plan matching funds if offered, and you’ll get there!